Does your cosmetic institute or medical spa offer microdermabrasion? If so, you’ve made an excellent choice. As market research shows, the industry should enjoy average annual growth of 8.6% through 2026. By that time, the market will reach $650 million in market size.As the owner of a spa or salon, you undoubtedly want to tap into that market. First of all, as the American Society of Plastic Surgeons notes, by offering microdermabrasion, you can help patients exfoliate the skin, reduce wrinkles, eliminate enlarged pores, and treat acne and scars. You’re doing a good thing. You can help people treat skin issues and give them more confidence. Second, you can make good money. And that will benefit your medical spa or salon. Of course, to get the most financial benefit from microdermabrasion treatments, you need to handle your finances well. That begins with ensuring you don’t waste money on unnecessary expenses. If you look closely at your balance sheet, you may see that you waste money on something you don’t want to be: credit card processing fees! Now, you may think there’s no way to stop that. Think again!Read on—we’ll teach you why you should care about microdermabrasion credit card processing fees and how you can take home 100% of your microdermabrasion revenue.

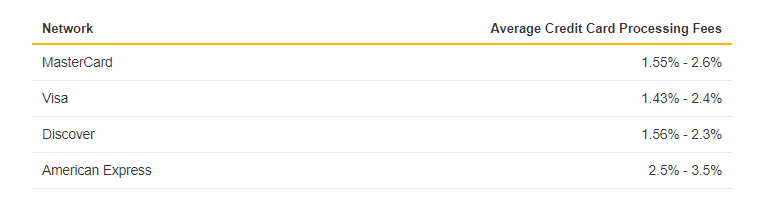

If you look at average credit card processing fees, you may think: What’s the big deal? It’s just 1.43-3.5% per transaction.

Source: ValuePenguin

Well, it’s not that simple. Chances are you pay more than the credit card processing fee rates listed above. That’s because merchant service providers (MSPs) charge markups in the form of monthly subscriptions, hardware fees, and other services. Still, even if you pay 3-4% in credit card processing fees per transaction, what’s the big deal? Well, consider what you’ve sacrificed to get here. To offer microdermabrasion and run your own medical spa, you’re either a professional dermatologist or plastic surgeon. So you’ve put in a lot of work and money to get to where you are. Remember the investment you’ve made in yourself. After all, starting a medical spa easily costs six figures, and could even near $1 million. That doesn’t even account for the student debt you’ve taken on to become a dermatologist or plastic surgeon (according to NerdWallet research, average medical student debt nears $200,000).Moreover, you have ongoing expenses at your medical spa. That includes technician salaries, insurance, rent, equipment, and more. The point is this: You’ve put it on the line to offer microdermabrasion and become an entrepreneur in the cosmetics industry. Don’t let money slip away unnecessarily…

Since microdermabrasion is almost always considered cosmetic, it’s not covered by insurance. Most of your clients will pay out-of-pocket. Considering the average cost of a microdermabrasion treatment ranges from $75-$200+, your clients are more likely to pay with a credit card. As research from Statista shows, credit cards are most often used for transactions around the price of microdermabrasion treatments.

Source: Statista

Given the data, it’s possible a good portion of your microdermabrasion revenue comes via credit card transactions. If you haven’t yet, calculate the numbers. So that you can more clearly see how credit card processing fees impact your business, let’s say 50% of your microdermabrasion revenue is from credit cards.And let’s say your medical spa does 2,000 microdermabrasion treatments per year. Clients pay an average of $150 per microdermabrasion treatment. That means you generate $300,000 per year in microdermabrasion revenue. Now, think about this:

Obviously, you can’t let that happen. To maximize your revenue from microdermabrasion, you must eliminate credit card processing fees.Just think: If you eliminate that $6,000 per year you pay in credit card processing fees, your microdermabrasion revenues would increase from $45,000 to $51,000. That’s a profit increase of 13.3%!Now, you may wonder: Can I really eliminate all credit card processing fees? The answer is yes. Yes, you can!

By hiring the right payment processor, you can ensure you take home more of your microdermabrasion revenue. When looking at third-party credit card processors, examine the following:

For your medical spa, choose the payment processor that offers the best combination of low fees and quality processing. Also, check to ensure they don’t assess additional fees, like cancellation fees. Because if a transaction is canceled, you shouldn’t have to pay credit card processing fees. Additionally, look out for rate increases in the contract with your MSP. Credit card processing fees are a percentage of each transaction, and therefore do not correlate with inflation. Credit card processing fees should remain the same, regardless of how much the dollar is worth. Make sure of this when hiring an MSP for your dermabrasion clinic. To summarize, look for the credit card processor that offers efficient credit card processing and low fees. And don’t be afraid to negotiate the MSP markup. Many business owners have been able to get 5-10% off the processor markup.

Obviously, you can’t eliminate credit card processing fees just by finding the cheapest processor. You need an additional strategy. Enter the cash discount program—your strategy to ensure you never lose money to credit card processing fees. As the name implies, your microdermabrasion clients get a discount for paying in cash. With NadaPayments’ cash discount program, that discount equals 3.95%. If they pay with a credit card, they pay a markup fee to offset the credit card processing fees. In this sense, the cash discount program benefits both the spa owner and client. The client can still pay with a credit card—just at an additional cost. If they want to save money, they can pay in cash. And, in the end, the salon owner can ensure they collect the right amount of revenue. Worried about whether you can really offer this? The good news is this: The cash discount program is 100% legal and compliant.Want to learn more? At NadaPayments, we can help your medical spa or clinic take home 100% of their microdermabrasion revenue. Just call us at +1 (929) 293-1800 or click the link below to message us.